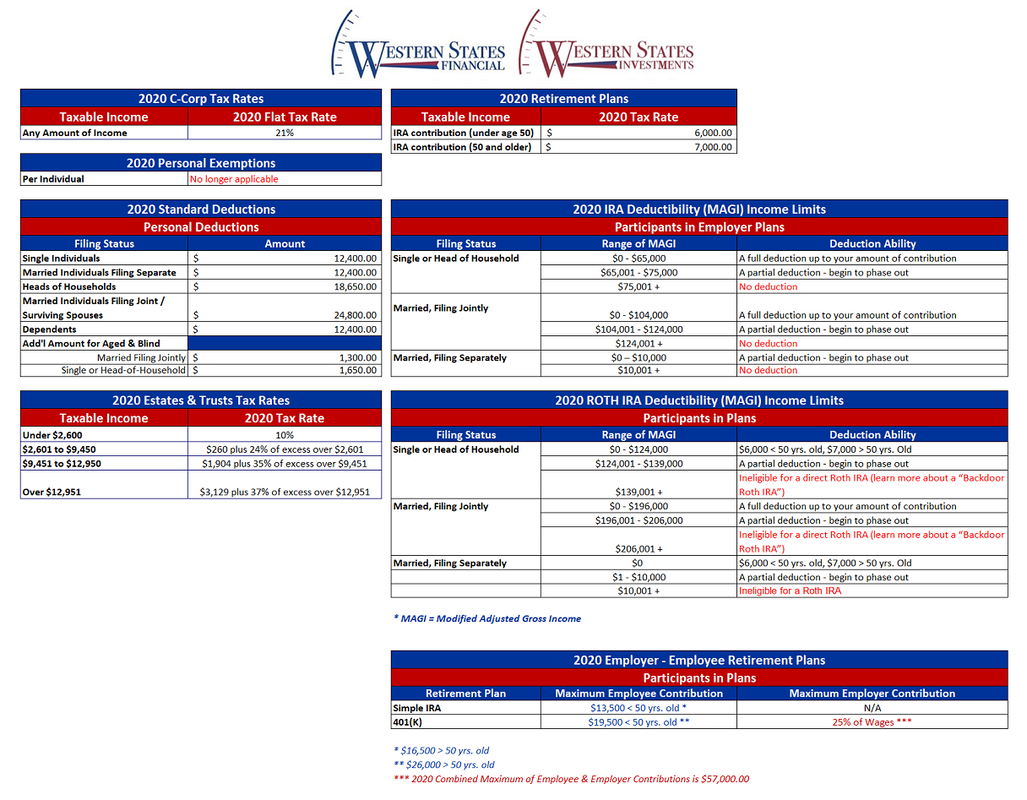

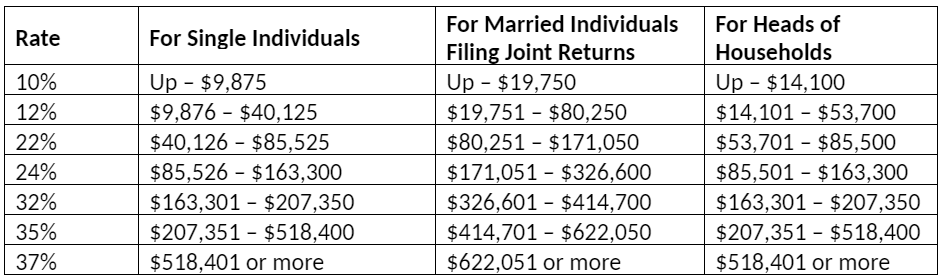

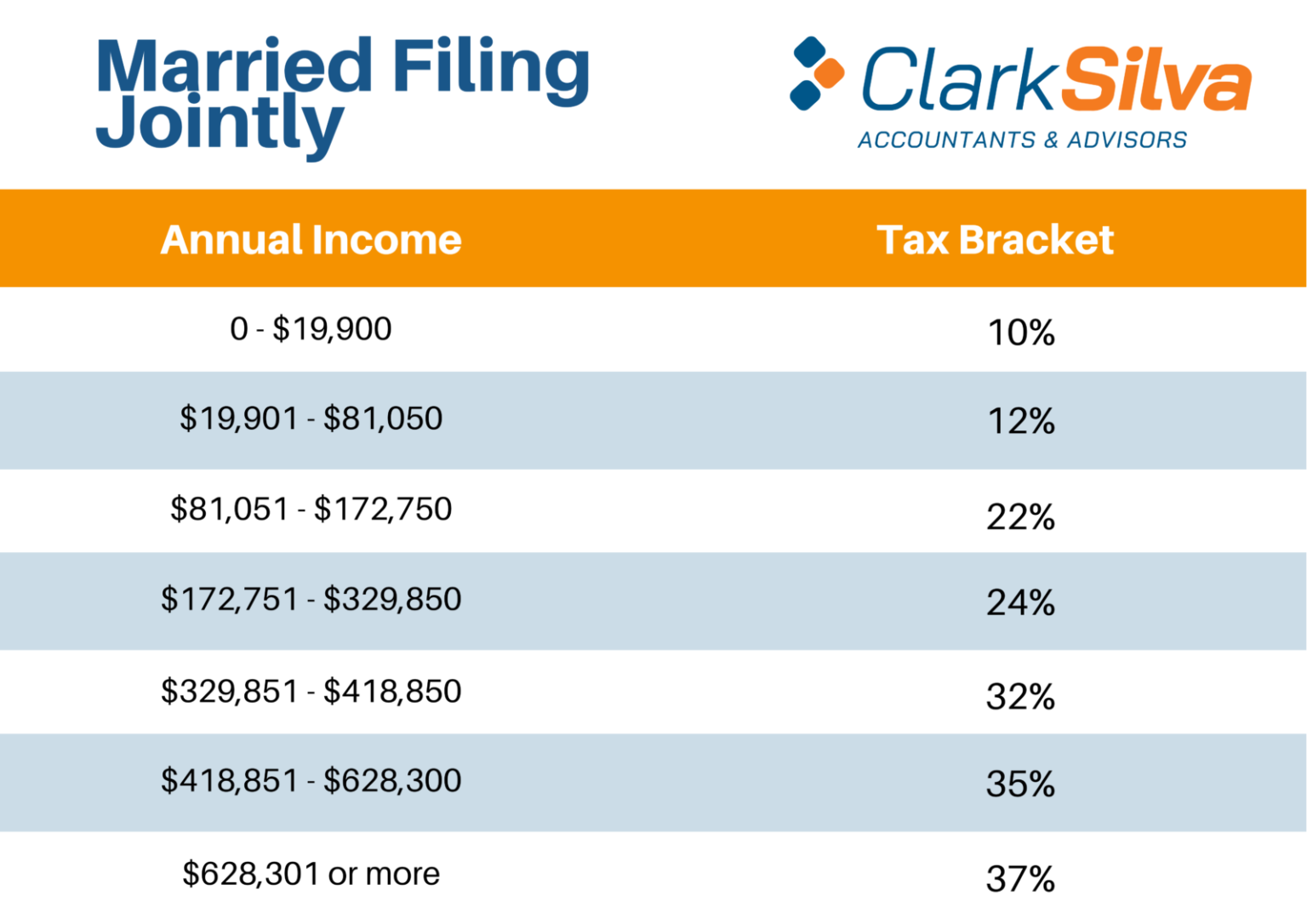

Again, you would not pay 22% on your entire taxable income. Your effective tax rate is 11.4%, which is your total tax of $4,001 divided by your taxable income of $35,000.Įxample #2: If you file single with an income of $70,000, you are in the 22% tax bracket. If you paid a straight 12% on all of your income, you’d pay around $200 more. Without considering any deductions, credits or other taxes and fees, this puts your total federal income tax at $4,001.00. Next, you would pay 12% on the remaining $25,050 of your income, which is $3,006. You would pay 10% on your income up to $9,950. However, that doesn’t mean that you’ll pay 12% in taxes for all your income. As you work through your taxes, it’s important to remember that your taxable income will likely be taxed at several different rates.Įxample #1: If you’re single and you earned $35,000 worth of taxable income, that would put you in the 12% federal income tax bracket. Once you determine your tax bracket, you can find out how much you owe the IRS. However, if you got married on January 1, 2022, you cannot file with a married status when you turn in your 2021 income taxes in April 2022. You can determine your status of married or single based on the last day of the tax year.įor example, if you got married on December 31, 2021, you would be able to file as married for tax purposes. There are four different filing statuses that you can choose, according to the IRS: single, married filing jointly, married filing separately and head of household. The second piece of the puzzle is your filing status. This is the money that you have earned minus any tax cuts or deductions. The taxable income part is easy to determine. Your income will fall into federal tax brackets that are based on two factors: your taxable income and your filing status. Prior to this legislation, the 2018 tax brackets were slightly higher at 10, 15, 25, 28, 33, 35 and 39.6%.

The Tax Cuts and Jobs Act of 2017 did make some reductions to income tax rates that effectively lower the amount individuals will pay in taxes. However, every taxpayer pays equal taxes on each portion of their taxable income.Ĭurrently, there are seven federal tax brackets that have tax rates of 10, 12, 22, 24, 32, 35 and 37%. This leads to people who earn a higher income paying more in taxes. As you earn more income, parts of your higher earned income will be taxed at a higher rate. Different portions of your income are taxed at various rates.

#US TAX BRACKETS 2020 CODE#

In the United States, the tax code is based on a progressive system. This chart shows the federal tax brackets for the tax return due April 2023, for tax year 2022. The only change is that the cutoff amounts have been indexed for inflation. While the tax laws can change at any time, as of now the tax brackets remain the same as the 2021 income tax brackets.

Please contact us if any of our Federal tax data is incorrect or out of date.If you're looking to plan ahead, you can also consider the 2022 tax brackets which have already been released by the IRS.

Is info on this page missing or out-of-date? Please let us know so we can fix it! Tax Data Sources: Disclaimer: While we do our best to keep our historical Federal income tax rates up to date and complete, we cannot be held liable for errors or omissions.

0 kommentar(er)

0 kommentar(er)